An emerging market is a term used to describe a country or region experiencing rapid economic growth and industrialization. They offer opportunities for traders due to their potential for high returns, and many are considered frontier markets, meaning they are less developed than more established markets.

An emerging market (also known as a developing economy) is a country with a rapidly increasing economy. It may have some of the features of a developed country, such as a high GDP or broad industrialization.

There is no commonly agreed definition of an emerging market, but they are often nations with economies that are still in the early stages of development – frequently with big, young populations, a rising middle class, and the potential for high economic growth.

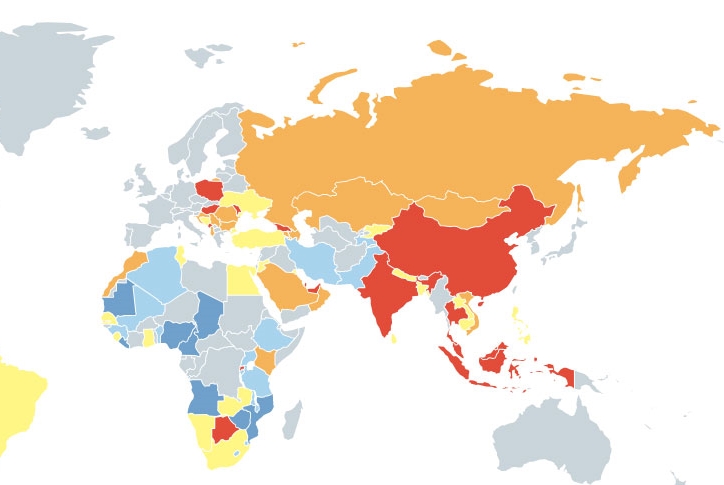

Brazil, Russia, India, and China are all important emerging markets (together known as the BRIC nations). These countries are expanding their markets and gaining prominence on the world scene.

Why Is It Important To Find Emerging Markets?

Emerging market economies, which are amid industrialization, often have a unified currency, stock market, and financial system. Because of their fast expansion, emerging market economies can provide higher returns to investors, but they also expose investors to more inherent dangers.

The greatest advantage of investing in developing markets is the possibility of rapid development. Diversification. Because economic downturns in one country or area, including the United States, can be countered by growth in another, international investments can be a beneficial diversifier for your investment portfolio.

Several additional factors may be as significant in emerging markets. These include the region’s political and economic standing, the ease of doing business there, the cost and time needed in establishing a firm, availability to finance, and other factors.

Emerging-market governments often pursue policies that promote industrialization and rapid economic expansion. These policies result in decreased unemployment, more disposable income per capita, increased investment and improved infrastructure.

Here are ways for identifying an emerging market:

- Look at the GDP growth rate.

GDP growth is a crucial indicator of an emerging market. Countries with a GDP growth rate of over 7% are generally considered emerging markets.

- Look at the level of development.

The United Nations Development Programme (UNDP) produces a Human Development Index (HDI), which ranks countries based on life expectancy, education levels, and standard of living. Countries with a high HDI are more developed, while those with a low HDI are less developed.

- Look at the degree of political and economic liberalization.

Emerging markets tend to be countries that have undergone political and economic liberalization. This process can be measured using the Economic Freedom Index, which ranks countries based on their level of economic freedom.

- Look at the level of inflation.

Inflation can be a good indicator of an emerging market as it often signals economic instability. A country with an annual inflation rate of over 10% is generally considered an emerging market.

- Look at the level of debt.

A high level of debt can signify that a country is in financial trouble and is, therefore, more likely to experience a financial crisis. Countries with a debt-to-GDP ratio of over 60% are generally considered emerging markets.

- Look at the level of foreign investment.

Foreign investment is a crucial indicator of an emerging market as it shows that investors are confident in the country’s economy. A country with a high level of foreign investment is generally considered an emerging market.

- Look at the rate of economic growth.

The rate of economic growth is another crucial indicator of an emerging market. A country with a GDP growth rate of over 7% is generally considered an emerging market.

- Look at the level of corruption.

A high level of corruption can signify that a country is not well-managed and is, therefore, more likely to experience economic problems. Countries with a high level of corruption are generally considered emerging markets.

Here are some factors to consider when trying to identify an emerging market:

- Population

A large population is generally seen as a positive sign for an emerging market, indicating a potential for future growth. Additionally, a young population is often seen as more dynamic and entrepreneurial, leading to a robust economy.

- Urbanization

As countries urbanize, their economies tend to grow as well. It is due to the increased productivity of density and the clustering of businesses and services. Additionally, urban areas are often centres of innovation.

- Income levels

Low-income levels indicate that there is room for economic growth. As incomes rise, so does consumption, leading to further economic expansion.

- Political stability

Emerging markets can be volatile, so it is vital to consider political stability before investing. A stable government is more likely to enact policies conducive to economic growth. Additionally, countries with high levels of corruption tend to be less stable and riskier.

- Economic growth

Of course, you want to invest in a market that is growing. Look for signs of recent economic growth, such as increasing GDP, declining unemployment, and rising incomes. These are all good indicators that an economy is on the upswing.

The ETFs to look for

Now that you know what to look for, it’s time to start investing. Here are a few ETF trading options that focus on emerging markets:

- iShares MSCI Emerging Markets Index ETF (EEM)

This ETF tracks an index of over 800 stocks from 23 emerging market countries.

- Vanguard FTSE Emerging Markets ETF (VWO)

This ETF tracks an index of over 1,500 stocks from 24 emerging market countries.

- WisdomTree Emerging Markets SmallCap Dividend ETF (DGS)

This ETF focuses on small-cap companies in emerging markets and pays a dividend yield of 2.87%.

Conclusion

To conclude everything in a few words, the intrinsically unpredictable nature of developing markets, as well as their transitional qualities, make policymaking extremely difficult in these economies.

Long-term investments need consistency and dependability. Due to a lack of established institutions with a sense of stability due to a lack of established institutions with a track record.

In the absence of institutions’ ability to give the essential commitment to wise policies, the alternative of transactional commitments becomes appealing. As a result, pledges reflected in individual contracts may serve as a viable replacement for an established institutional structure.

Also Read: